Manual paperwork

Human errors, data loss, and cumbersome processes

Point solution chaos

Fragmented data, inconsistent data formats, and inefficient cost distribution

Sensitive data exposure risk

Potential vulnerabilities during file transfers between different tools

Complex resource management

Difficulties in human resources, and cost management due to fragmented solutions

Time-consuming processes

Extended delays between the submission and review of tax forms with manual methods

Eco-unfriendly practices

Reliance on paper forms, letters, and physical archives

01.

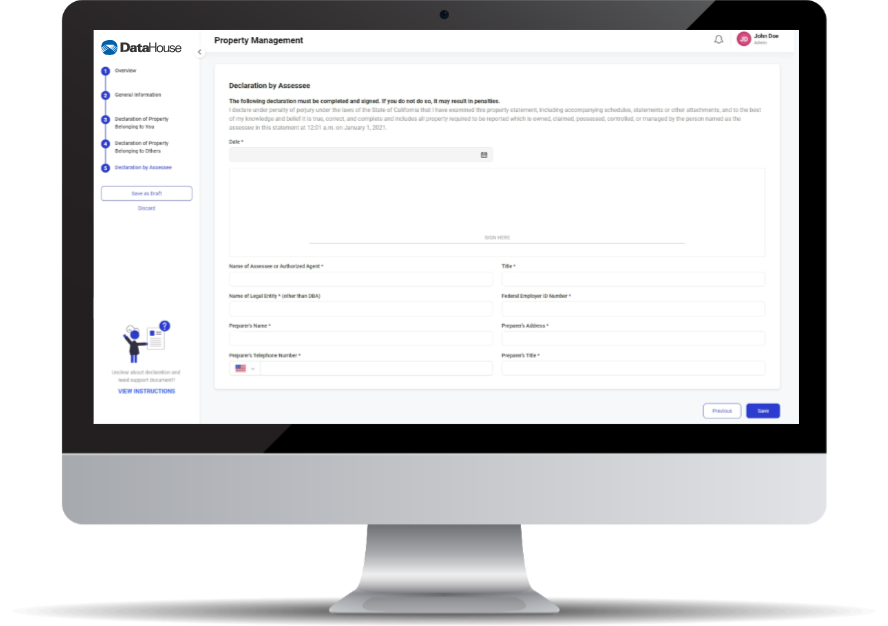

Customizable forms and workflows

Customizable forms and workflows

Easily create, configure and adjust tax forms and automate workflows to suit your needs.

02.

Streamlined statement processing

Streamlined statement processing

Boost productivity with features that aid in reviewing, tasks distribution, calculations, and decision-making.

03.

Efficient property and user management

Efficient property and user management

Manage business properties effortlessly and enjoy a robust user administration space.

Efficient Management

Including properties, e-filing statements with historical data available for review or amendment

Seamless Experience

Designed for everyone, even non-tech users

Resources Optimization

Save time and effort and increase productivity with our intelligent features

Bridge Communication Gaps

Connect smoothly with Taxpayers through Statement processing, correspondence and auto-status update

1. What is business personal property?

2. How does the software handle document storage?

3. Do I need to download any software?

4. How will you keep my data secure?

5. What does the implementation process look like?

6. Do you cover the training?

7. What third-party applications are integrated with the software?

8. How will it make my tax team more efficient?

9. Does it give you the ability to view analytics for returns, assessments, and tax bills?

10. Does it give you the ability to create and assign tasks to users?

11. What kind of reports can we export from it?

12. Is there any limitation in the number of users?

13. If we got hacked or lost the data, how can we recover it? Do you have any backup system?

14. We have our payment gateway, can we integrate it with VizBPP?